Metrics for success. Do you know which KPIs and metrics you should track to have the most significant impact on your revenue cycle and ultimately boost your profits? Read our blog to find out everything you need to know.

AIMA help the full spectrum of healthcare businesses, including physician practices, surgical centers, laboratories, healthcare groups, urgent and in-patient treatment centers and large-scale health systems across the US. And, do you know the most common challenge faced by them all? It’s knowing if their healthcare business could be more efficient and ultimately more profitable. So that’s where we come in. Our expertise is to focus on customers’ sustained commercial growth, leaving them to focus on their patients.

With 25 years of industry experience, we know that taking a proactive approach to metrics and medical billing processes prevent problems before they happen. Moreover, they ensure you’re correctly and promptly reimbursed. A data-driven approach to revenue cycle management (RCM) is one of the most proven routes to financial improvement for physician practices, surgical centers and laboratories. But, how can you be sure your processes are effective for capturing the revenue you have earned? Which metrics and KPIs are worth monitoring? Knowing where to begin can be daunting. Well, look no further. We have broken down the five most important metrics your organization should consistently track to evaluate your RCM processes’ effectiveness.

Here are the five most important proven metrics you should be tracking to grow your healthcare business.

1. AR Days

Why monitor? AR days or days in Accounts Receivable measures the amount of time it takes to receive payment on a claim, helping you to identify potential revenue cycle issues and measure the efficiency of your billing team. High AR days should sound a clear warning alarm to business owners as it can negatively impact your bottom line. Our advice to improve your medical AR days:

- Submit claims daily

- Collect co-pays, coinsurance, and deductibles upfront

- Choose electronic billing options

- Enrol in electronic payment options

- Prompt follow up of aged claims

- Post payments with no delay

- Simplify the bills so easily understood by patients

How to calculate – Total Account Receivable/ (12 months of gross charges/365)

Target Benchmarks – The industry standard is 35 days. While an AR in the range of 60 – 90 days should raise a red flag.

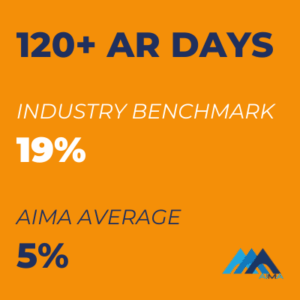

2. Percentage of AR Greater than 120 Days

Why monitor? A handy indicator to show whether your patients and insurers are paying you promptly. Often practices and billing companies choose not to pursue collections for outstanding AR cases greater than 60/90 days due to the enormous amount of labor-intensive work involved in collecting. However, at AIMA, we firmly believe this represents a significant cash loss for the healthcare business.

How to calculate – AR >120 days/ Total AR

Target Benchmark – You should strive to keep 120+ AR Days well below 25%. Anything higher is a sure sign of an inefficient patient payment process.

AIMA Average 120+ AR Days Rate is a 73% improvement on the industry benchmark.

Read our case study and learn how we helped a Florida cardiology clinic achieve an 85% decrease in 120+ AR to below $50k in a matter of months.

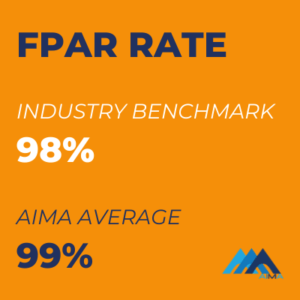

3. First Pass Acceptance Rate

Why monitor? First Pass Acceptance Rate (FPAR) or sometimes referred to as First Pass Clean Claim Rate (FPCCR), uncovers problems and inefficiencies in claim submission and processing, revealing the effectiveness of your claims processing and medical billing team.

A popular alternative to the Claims Acceptance Rate (CCR), which is a total rate of all claims submitted, even if rejected initially, First Pass Acceptance Rate only calculates acceptance based on the first submission of the claims. We believe this is a more accurate measurement of RCM service quality. It conveys how well the service validates claims and successfully processes claims through the clearinghouse edits during the first-time submission.

Improving FPAR will result in lower AR days and quicker payments. Errors, oversights, and inefficient billing processes are common culprits of a lower rate. In the case of a low rate of FPAR, you should immediately focus on insurance verification, billing, and coding for a more efficient Revenue Cycle Management (RCM).

How to calculate – # of claims paid on first pass/ total # of claims submitted in a time frame

Target Benchmark – The industry target is 98%. An efficient, well-run physician practice should be more than 90%.

AIMA Average First Pass Acceptance Rate is 1% better than the industry benchmark.

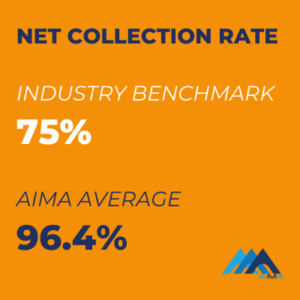

4. Net Collection Rate

Why monitor? Net Collection Rate (NCR) measures how much you are supposed to collect from both patients and their insurance companies. A high NCR reflects timely billing, adjudicated claims, and patient balances are all collected. Unlike gross charges, net collections represent what your business realistically can expect to receive in reimbursement. It reflects how denial rates, unreimbursed visits, and other factors affect revenue.

How to calculate – (Payments/(Charges-Contractual Adjustments)* 100%

Target Benchmark – If your NCR is lower than 90-100% after write-offs, you should consider an audit of billing practices.

AIMA Average Net Collection Rate exceeds the industry benchmark by 21.4%.

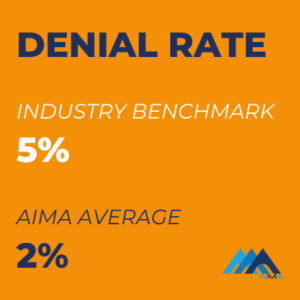

5. Denial Rate

Why monitor? Denial rate is the percentage of claims denied by payers and helps measure your revenue cycle management processes’ effectiveness. A low denial rate indicates healthy cash flow and provides insights into how efficiently your claims are processed. If the denial rate is not addressed in time, it will negatively affect other KPIs.

In our experience, the top causes of high denial rates are:

- Missing information. A required field left blank on a claim form or incorrectly entered patient information can trigger a claim denial.

- Duplicate claim or service. These are claims resubmitted for a single visit with one provider.

- The payer doesn’t cover service. Health insurance plans usually don’t cover all procedures, so before administering services, it’s essential to know what will or will not be covered.

- Improper or lack of coding. Code claims to the fullest level of specificity possible, with all identifiers and modifiers included every time.

- The patient is ineligible for services. To make sure your patient is covered by insurance, double-check their insurance information at the start of each visit.

- The claim is missing authorizations. If proper authorization for a service is not obtained before the patient receiving service, the claim will likely be denied.

- The time limit for filing has expired. Most payers require claims submission within a specific time window, even for complex claims.

- The service has already been adjudicated. A specific medical service was already included in a claim for another service or procedure already adjudicated by the payer.

How to calculate – Total # of claims denied/ Total # of claims submitted (for a specific period).

Target Benchmark – Between 5% and 10% denial rate is the industry average.

AIMA Average Denial Rate is 3% better than the industry benchmark.

So, there you have it, the top five RCM metrics to track to improve your healthcare business’s bottom line. If there is one take-away message here, giving your healthcare business, a regular financial check-up is vital. Tracking medical billing key performance indicators (KPIs) daily, weekly, monthly, quarterly, and yearly is critical to sustained commercial growth. Here at AIMA, we take away the hard work, worry and confusion and manage all of this for our customers.

*Industry Benchmark data correct April 2021 figures from Medical Group Management Association (MGMA)

Contact us today to find out how AIMA will help you achieve a fully optimized healthcare business.

Ready to Get Started?

Contact AIMA Business and Medical Support today. Our friendly team are on available to answer your questions.

"*" indicates required fields