AR Accounts Receivable Case Study

Florida-based cardiology clinic achieves a 65% decrease in 30+ AR days and an 85% decrease in 120+ AR days.

Find out how the AR team at AIMA helped our client improve their accounts receivable processes. See how they benefitted from cleaner claims and speedier reimbursement. Learn how your healthcare business can improve your cash flow and get you paid quicker.

AR Services from AIMA

An intelligent, well-implemented accounts receivable strategy is vital to successful revenue cycle management. Your dedicated AIMA team harness years of experience with proven best-practice methods to collect the payments owed to you. We reduce Accounts Receivable backlogs by identifying the problems and implementing long-term solutions.

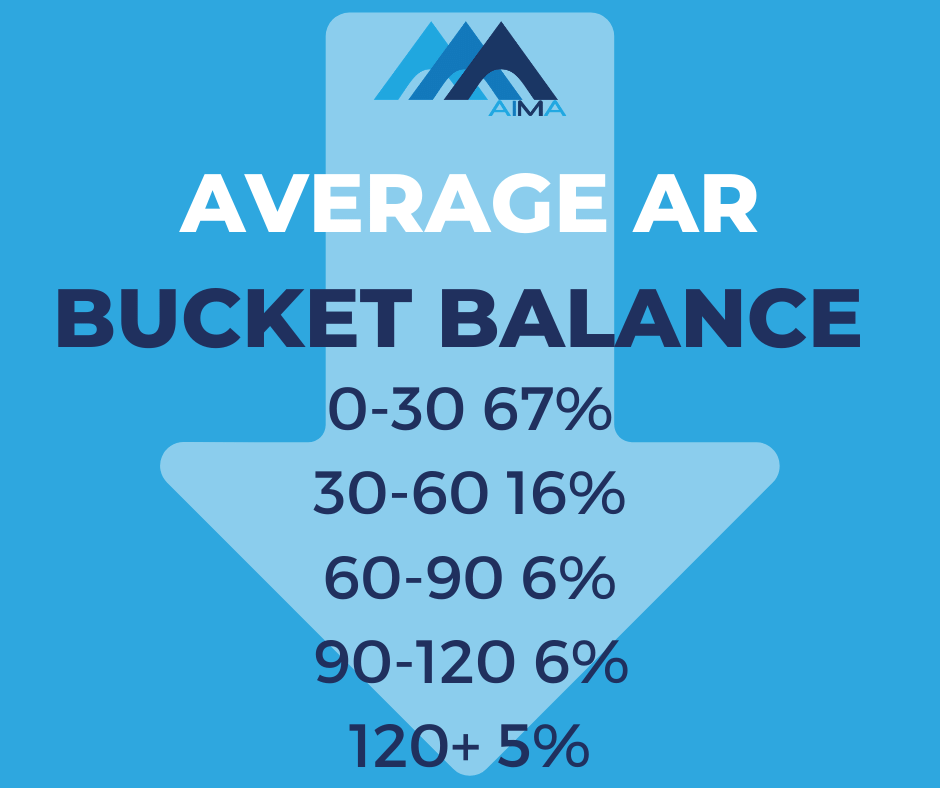

Days in AR are key performance indicators that drive any medical-related practice or organization’s success. AR days measures the amount of time it takes to receive payment on a claim. According to industry benchmarks, AR days for can range between 30 and 60 days.

Get paid faster with AIMA. We take away any payment uncertainty or worry, allowing you to grow your healthcare business and care for your patients. We are proud of our consistent AR results.

AR Accounts Receivable Case Study - Florida Cardiology Clinic

SCENARIO

Central Florida-based cardiology and vascular clinic had built up a vast aging balance. Their previous billing company had allowed significant medical coding, billing and authorization issues to mount up, resulting in a troubling scenario for the clinic of 30+ AR days of over $475k and 120+ AR days close to $300k.

SOLUTION

AIMA began working with the cardiovascular specialists in March 2020, achieving almost immediate improvements in their claims and reimbursement results. Our priority was to appoint a dedicated AR team of RCM professionals with experience in clearing historical aging debt.

The AIMA team identified several significant issues with their coding, billing and authorization processes causing the worrying large aging balance:

- Billing Errors

- Coding Errors

- Eligibility Errors

- Authorization & Referral Errors

- Pending for MR & In-process

- Current denials & incorrect denials

- Non-Collectable Dead AR

BILLING ERROR ISSUES | AIMA ACTION |

ISSUE: MISSING THE CODES | ACTION: Pre-billing audit to summarize the billable codes for DOS and pick correct codes to bill. |

ISSUE: HIGH CLAIM BILLING LAG | ACTION: 24-48 hours turnaround time on coding/billing from the DOS. We reduce the billing lag to a maximum of three days. |

ISSUE: DOS MISSED TO BILL | ACTION: Reconciliation of appointments before billing. Summarize the billable appointments and send routine exceptions avoids any missed billing. |

ISSUE: CPTS BILLED WITH NO CHARGE AMOUNT | ACTION: Reconfiguration of all fee schedules and set standard billed amounts for all the CPTs in the system. |

ISSUE: CPTS BILLED WITH INCORRECT CHARGE | ACTION: Establish standard fee schedules as per the provider's requirement. Set the billed amount as 1.5 times Medicare allowable across the system. |

ISSUE: CLAIMS BILLED TO WRONG PAYERS | ACTION: Implement verification reports to identify the right payers to bill on DOS. |

ISSUE: CLAIMS BILLED WITH MISSING/INVALID AUTHORIZATION | ACTION: Post-billing audit to identify any vital info omitted in the claim. Scrubbing rules in the clearinghouse portal to avoid further rejections or denials. |

CODING ERROR ISSUES | AIMA ACTION |

ISSUE: INADEQUATE CODES BILLED | ACTION: Pre-billing audit of all chart notes, procedure notes and test results. We identify the correct codes as per the provider documentation. |

ISSUE: INCORRECT/MISSING MODIFIERS | ACTION: Coding audit to identify the requirement of modifiers on E&M codes and distinct procedures and append the correct modifiers for better reimbursement. |

ISSUE: GLOBAL PROCEDURES BILLED | ACTION: Reduce the volume of denials from payers by appending the correct post-op modifiers once a consultation or procedure is complete during the post-op period. Claims not covered as per the post-op coding guidelines are written off with provider approval. |

ISSUE: INCORRECT DOCUMENTATION | ACTION: Streamlined process to create clean coding/billing practices and meet payer audit requirements. Daily check of provider documentation and advise providers on any incomplete/missing/unsigned notes in the system. |

ISSUE: INCORRECT UNITS | ACTION: Coding audit to identify and fix incorrect unit cases. |

ISSUE: MEDICAL NECESSITY NOT CHECKED | ACTION: Once consult/procedure is complete, the new method identifies the proper LCD/NCD guidelines for correct billing. |

ISSUE: PAYER GUIDELINES NOT FOLLOWED | ACTION: Correct coding protocols followed as per each guideline to increase reimbursement and reduce denials. |

ELIGIBILITY ERROR ISSUES | AIMA ACTION |

ISSUE: BILLED WITH INCORRECT POLICY NUMBERS ISSUE: BILLED WITH INACTIVE POLICY | ACTION: Pre-verification of eligibility and benefits. Any changes in the eligibility/policy/plans identified before the appointment date and communicated to the front office or patient accordingly. |

AUTHORIZATION OR REFERRAL ERROR ISSUES | AIMA ACTION |

ISSUE: AUTHORIZATION NOT OBTAINED | ACTION: Pre-verification and |

ISSUE: AUTHORIZATIONS/REFERRALS NOT UPDATED | ACTION: Authorization and follow up process to update the information accordingly and |

DENIAL ISSUES | AIMA ACTION |

ISSUE: CLAIM PENDED FOR ADDITIONAL DOCUMENTATIONS | ACTION: Tracking denials and correspondence with denial management within 24-48 hours of receipt. |

ISSUE: ERAS NOT RECEIVED | ACTION: Electronic claim and payment transactions to save time and speeds up reimbursement. Practice enrolled for EFT/ERA with maximum payers. 95% of payments now deposited through EFT, and payment explanation loaded via ERA directly into the system. Payments posted on time and payment lag reduced. |

NON-COLLECTABLE DENIAL ISSUES | AIMA ACTION |

ISSUE: SECONDARY DENIED AS PRIMARY PAID MAX | ACTION: Monthly review of non-collectable denials and writing off upon provider approval. |

ISSUE: NON-COVERED CHARGES AS PER PROVIDER PLAN ISSUE: TFL CROSSED ISSUE: CLAIMS DENIED AS NO AUTHORIZATION | ACTION: Credentialing and contracting processes with new payers, communicated to the front team or patient on non-accepting payers/policies. |

RESULT

Since working with our dedicated AR team the cardiology clinic clean claims and reimbursement results have improved significantly.

65% decrease in 30+ AR to $167k

85% decrease in 120+ AR to below $50k

We do not know how we could have survived without all of your help. You have overseen transitioning our billing department to the most successful it has been in our history. We have also moved a significant portion of our back-office work to AIMA to provide us with stability and confidence to grow when most private practices are regressing. We have developed a transcription team to create our notes to spend more time with patients and less inputting data. Plus, we’ve been innovative in getting Spanish-speaking operators and adding a nurse to the workflow. We are now adding the social media and website to our AIMA portfolio. We keep giving your team ideas, and you all make them happen. We look forward to what the future has in store.

Cardiology Clinic, Florida

Advice to Reduce Accounts Receivable Days and Maximize Payment Flow

- Submit claims daily

- Collect co-pays, coinsurance, and deductibles upfront

- Choose electronic billing options

- Enrol in electronic payment options

- Prompt follow up of aged claims

- Post payments with no delay

- Simplify the bills so easily understood by patients

Why choose AIMA

- We collect the money owed to you

- We boost your revenue

- We only bill what we collect

- We achieve savings and increase your income

- We offer a 24-hour backup service of a skilled, experienced, customer-focused team

- We are 100% customer focused and tailor our services to meet your business needs

Contact AIMA Business and Medical Support

Call Us Now (321)236-8300 sales@aimabms.com

Contact AIMA Business and Medical Support today to discuss how we can help your healthcare business. Our friendly team are on hand to answer your questions.

AIMA Customer Testimonials and Feedback

With over 500 global customers operating across several business sectors, we are immensely proud of our consistently positive feedback and testimonials. Here at AIMA, we have an individual customer approach. Our dedicated account managers build a collaborative relationship with you to gain a unique understanding of your business, its challenges and most importantly, its opportunities. Your success is ultimately our success, and we love sharing your positive messages.